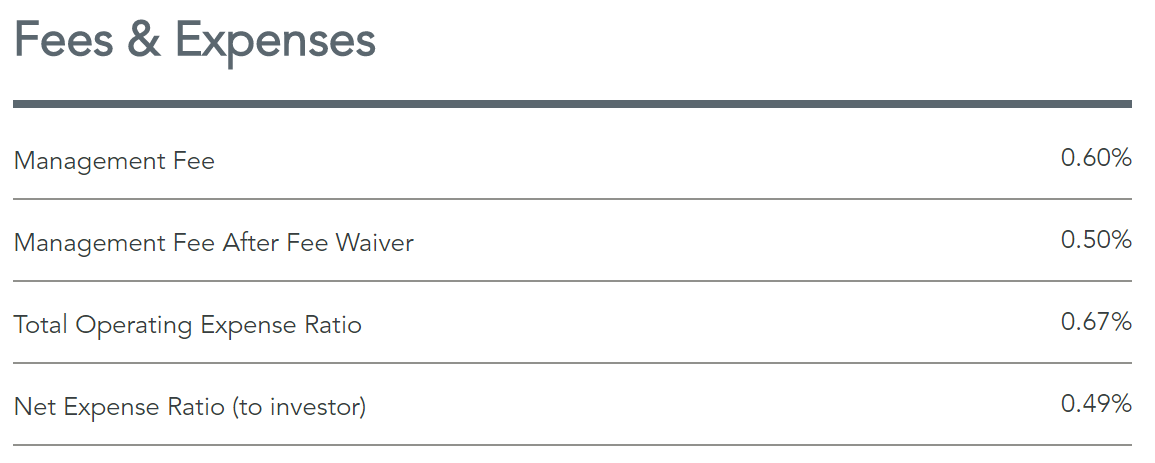

*2018 returns used – aligns closely with returns since fund inception.Īnd from that huge chart of technical mumbo jumbo, here’s the part that actually matters to you: Monday-Friday phone support from 8 AM – 10 PM ET.Fidelity: The Money Wizard’s Final Conclusion Which company has the better structure for shareholders?.Who’s been more trustworthy in the past?.Who is actually more tax efficient? Vanguard or Fidelity?.Do we expect Vanguard or Fidelity to be more tax efficient?.Round 4: Underlying Diversification of the index funds.Round 3: Securities Lending and Index Fund Tracking.How is Fidelity able to offer funds for free, anyway?.

#VTSAX EXPENSE RATIO FREE#

And they’ve now taken the arms race to uncharted territory – Fidelity is literally offering FREE index funds. If you’ve followed the investing headlines (or even just watched the Super Bowl commercials) you’ve probably already heard the shocking news.įidelity’s declared war with Vanguard.

0 kommentar(er)

0 kommentar(er)